The Long-Term Effects of Financial Stress on Health

Financial stress is a common challenge that affects many individuals, and its effects can be deeply detrimental to one’s overall health. When financial pressures mount, individuals often experience an increased level of anxiety and worry. Chronic stress resulting from financial difficulties can lead to numerous health problems, including mental health disorders like depression and anxiety. Furthermore, long-term financial stress can weaken the immune system, making individuals susceptible to illnesses. Alongside these effects, behavioral patterns such as unhealthy eating and lack of exercise often emerge. Prolonged financial strain can lead to inadequate self-care practices, exacerbating health conditions over time. For example, people may neglect doctor visits or fail to take prescribed medications. The cumulative impact can put individuals at increased risk for chronic conditions such as heart disease and hypertension, which can further complicate financial situations due to medical expenses. Addressing financial stress effectively is crucial for maintaining one’s health and well-being. Seeking support from professionals or financial advisors can provide valuable strategies to manage stress and regain control over finances.

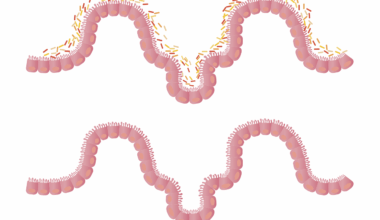

As long-term financial stress impacts health, it’s essential to recognize how this stress translates into specific physical symptoms. People often report experiencing headaches, gastrointestinal issues, and chronic pain conditions related to stress. The body reacts to stress by producing hormones like cortisol, which are meant to help in short-term emergencies but can become harmful when constantly elevated. Over time, the constant presence of such hormones can lead to profound health issues, including obesity, diabetes, and cardiovascular diseases. This cycle can perpetuate further financial woes, as medical bills accumulate, creating a feedback loop of stress and health decline. It’s vital to be aware of these symptoms and understand they are not just isolated incidents but rather manifestations of a deeper issue. Taking proactive measures, such as lifestyle changes or seeking mental health support, can mitigate this health decline. Engaging in regular exercise can lower stress levels and improve mood. Identifying and managing financial stressors through realistic budgeting, financial planning, or seeking counseling may also foster a calming effect, positively impacting both mental and physical health. Acknowledging the interconnectedness of finance and health is key to breaking free from this cycle.

Understanding Financial Stress

Financial stress fundamentally arises when individuals perceive their financial situation as overwhelming and out of control. This perception can stem from various sources, such as job loss, overwhelming debt, or unexpected expenses. The impact of this stress often extends beyond the wallet and seeps into every aspect of life, affecting relationships, work performance, and overall happiness. Many people struggling with financial stress find themselves withdrawing socially, which only compounds feelings of loneliness and isolation. It’s important to recognize that financial stress is not simply about individual responsibility or budgeting but is influenced by larger factors, including economic trends and access to resources. Research shows that during economic downturns, levels of reported financial stress typically increase significantly. Acknowledging these factors can help destigmatize financial struggles, promoting empathy and communal support. Financial literacy plays a pivotal role in combating this stress, as those who understand personal finance tend to manage their situations more effectively. Consequently, education on budgeting, saving, and investing can be powerful tools for reducing financial strain, leading to better mental health and a more secure future.

To combat the long-term effects of financial stress on health, developing effective coping strategies is critical. Mindfulness and stress management techniques, such as meditation and yoga, can aid in alleviating feelings of financial concern. Mindfulness encourages individuals to focus on the present moment rather than worrying about past mistakes or future uncertainties. These practices can improve mental clarity and emotional resilience. Moreover, confiding in support networks can significantly diminish the sense of isolation often felt during financial hardships. Engaging with family, friends, or support groups can provide necessary emotional support, allowing individuals to feel validated in their experiences. When people share their stories and strategies, they can collectively seek solutions, fostering a sense of community and shared experience. Additionally, setting realistic financial goals can empower individuals and create a sense of control over their financial situation. Breaking larger goals into smaller milestones can provide motivation and acknowledgment of progress, reducing overall feelings of overwhelm. Remember, taking small steps toward financial health can significantly improve one’s psychological well-being and physical health in the long run.

The Importance of Seeking Help

Seeking professional help during times of financial stress can prove beneficial for both mental and physical health. Financial advisors can offer expert guidance in navigating complex financial landscapes, helping individuals develop effective strategies for managing their finances. With a solid plan in place, stress levels can decrease significantly, allowing people to focus on maintaining their overall well-being. Additionally, mental health professionals can assist in addressing the emotional toll that financial stressors take. They provide coping mechanisms and therapeutic techniques to deal with anxiety and depression associated with financial issues. Furthermore, combining both financial advising and mental health support creates a comprehensive approach that addresses the interconnected challenges of finances and health. Programs that promote holistic well-being often encourage individuals to take proactive steps in managing stress. Participating in workshops or community classes related to financial literacy can improve knowledge and confidence, reducing anxiety surrounding money. Thus, recognizing when to ask for help is crucial and should be viewed as a proactive step toward improving overall life quality. Whether through individual consultations or group settings, seeking support fosters resilience in the face of financial adversity.

A pivotal aspect of overcoming financial stress is learning to adapt to changing circumstances. Life is inherently unpredictable, which can lead to unexpected financial challenges. Building resilience by developing a flexible mindset can help individuals navigate financial turbulence more effectively. This includes recognizing that mistakes and setbacks are part of the learning process. By embracing a mindset of adaptability, individuals can approach financial challenges as opportunities for growth rather than insurmountable obstacles. Additionally, creating a financial cushion or emergency fund is a practical step that can alleviate future stress. Having savings can provide a buffer during tough times, empowering individuals to manage their finances with greater confidence. Regularly reviewing and adjusting financial goals can also enhance one’s adaptive capacity. As situations evolve, so too should strategies for managing stress and finances. Moreover, understanding the emotional triggers associated with financial anxiety can help individuals develop better coping mechanisms. This may involve reframing negative thoughts or practicing gratitude for what one has. Building a resilient financial and emotional foundation lays the groundwork for healthier responses to stress, ultimately leading to better health outcomes.

Conclusion: A Holistic Approach

In conclusion, the long-term effects of financial stress on health underscore the necessity for a holistic approach to well-being. Financial challenges are tied intricately to mental and physical health, creating a cycle that must be addressed through comprehensive strategies. Recognizing the symptoms and mechanisms of financial stress is the first step in disrupting this cycle. Adequate financial literacy, consistent self-care, and seeking professional help play significant roles in fostering resilience. Emphasizing mindfulness, connecting with supportive communities, and developing adaptive financial strategies can empower individuals. Acknowledging that financial stress is a shared experience can help reduce stigma and encourage people to reach out for help when needed. Strategies should focus not just on financial management but on cultivating a mindset that prioritizes emotional well-being. By embracing a proactive attitude and utilizing available resources, people can navigate financial challenges with greater clarity and confidence. Ultimately, understanding that financial health is intertwined with overall health can lead to a more fulfilling and balanced life. Reducing financial stress contributes to healthier individuals, families, and communities, making this a vital issue for public health advocacy.

In summary, recognizing the long-term effects of financial stress is crucial for individuals and communities. These effects extend beyond immediate financial concerns and deeply influence physical and mental well-being. Effectively addressing financial stress involves a multifaceted approach that incorporates education, support, and health management. By participating in financial literacy programs, individuals can better equip themselves with tools needed to manage their finances effectively. This, combined with having open conversations about financial struggles, can foster a supportive environment where individuals feel comfortable seeking help. Furthermore, communities can play a significant role by providing resources and support systems for those facing financial hardship. Combatting stigma surrounding financial difficulties is essential to encourage discourse and assist individuals in finding adequate help. The integration of mental health and financial counseling services can provide an essential framework for addressing both issues simultaneously. Ultimately, the incorporation of these strategies can lead to improved life quality for those affected by financial stress. Individuals can pave the way toward better health outcomes and greater financial stability by understanding the importance of comprehensive approaches to managing stress. This proactive stance is key to breaking the cycle of financial strain in both personal and communal landscapes.